Senior Membership Programs for Optimal Health: 5 Plans That Cover Medicare Gaps

As seniors navigate the complexities of healthcare, Medicare often serves as a foundational resource. However, gaps in coverage—like dental, vision, hearing, and prescription drug costs—can leave many older Americans vulnerable. Fortunately, senior membership programs are stepping up to fill these voids, offering tailored benefits that prioritize both health and financial security. Below, we explore five standout membership programs designed to optimize wellness and bridge Medicare’s coverage shortcomings.

Related searches

Medicare Advantage (Part C) Membership Programs

Medicare Advantage plans, offered by private insurers approved by Medicare, are among the most popular senior membership programs for comprehensive care. These plans bundle Parts A, B, and often D (prescription drugs), while adding perks like dental cleanings, gym memberships, and telehealth services. Many Medicare Advantage membership programs also include $0 premiums or low copays, making them a cost-effective solution for routine and emergency care.

By enrolling in these membership-based plans, seniors gain access to coordinated care networks and preventive services not fully covered by Original Medicare. Always compare plans during the Annual Enrollment Period to maximize benefits.

Medigap Supplemental Membership Plans

Original Medicare leaves deductibles, coinsurance, and overseas emergency care uncovered—gaps that Medigap (Medicare Supplement) membership programs address. Offered by private insurers, these plans help pay out-of-pocket costs, providing financial predictability. For example, Plan G, a popular Medigap membership option, covers nearly all deductibles and copayments.

These membership programs are ideal for seniors who value flexibility, allowing them to visit any Medicare-approved provider nationwide. Note: Medigap plans don’t include prescription drugs, so pairing them with a Part D membership program is wise.

Dental & Vision Membership Programs

Traditional Medicare excludes most dental and vision care, but specialized senior membership programs like Delta Dental’s “Seniors Plan” or EyeMed’s “Healthy Eyes for Life” fill this gap. These plans often cover cleanings, exams, dentures, eyewear, and even discounts on elective procedures like LASIK.

For under $30/month, these membership-based plans protect against unexpected expenses while promoting long-term oral and eye health—a critical focus for aging adults.

Prescription Drug Savings Membership Programs

Even with Medicare Part D, medication costs can soar. Programs like GoodRx Gold or SingleCare’s membership plans slash prescription prices by up to 80% at major pharmacies. These programs work alongside Part D, offering additional discounts on generics and brand-name drugs.

Seniors can enroll in these affordable membership programs (often under $10/month) to ensure medications remain accessible. Some even include free home delivery—ideal for those with mobility challenges.

Wellness-Focused Membership Programs

Preventive care is key to aging well, and programs like SilverSneakers® or Renew Active by UnitedHealthcare turn fitness into a Medicare benefit. These membership programs grant free gym access, virtual classes, and wellness coaching—promoting physical and mental health.

Other options, like AARP’s Staying Sharp® membership, focus on cognitive health with brain-training tools and expert resources. Such programs empower seniors to take charge of their well-being beyond clinical care.

Why Membership Programs Are a Game-Changer for Seniors

The beauty of these senior membership programs lies in their ability to personalize healthcare. Unlike one-size-fits-all Medicare, they cater to individual needs—whether it’s cutting drug costs, preserving vision, or staying active. Many also offer telehealth services, 24/7 nurse lines, and community support networks, fostering holistic health.

When evaluating membership-based plans, consider:

Your budget (premiums vs. out-of-pocket savings)

Health priorities (dental, fitness, medications)

Provider preferences (in-network vs. out-of-network flexibility)

Final Thoughts: Optimize Your Health with the Right Membership

Medicare is a lifeline, but its gaps can undermine financial and physical wellness. By pairing it with targeted senior membership programs, older adults gain peace of mind and comprehensive coverage. Whether you prioritize dental care, prescription savings, or fitness, there’s a membership plan to match your lifestyle.

Don’t wait—explore these programs during your next enrollment window or consult a Medicare advisor to tailor a strategy. With the right membership programs in place, you’ll invest not just in healthcare, but in a healthier, more vibrant future.

Fly Private for the Price of Economy

Discover Unmatched Relaxation with Luxury Swim Spa Services Near You

Breaking News: iPhone 16 Unveiled at Apple Latest Keynote Event

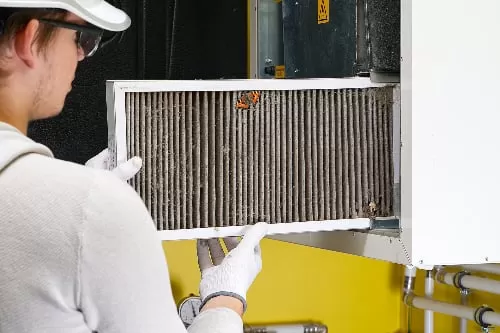

5 Essential Facts About Duct Cleaning You Need to Know

Breathe Easy with Professional Air Conditioner Cleaning Services

Transform Your Garage: Budgeting for Your Dream Space